REITs is Coming

On April 30, the China Securities Regulatory Commission and the National Development and Reform Commission jointly issued the "Notice on Promoting the Relevant Work of Real Estate Investment Trust Funds (REITs) in the Infrastructure Sector" (hereinafter referred to as "Notice") , which raised significant and strong response in the society.

Basic characteristics of international REITs

The full name of REITs is Real Estate Investment Trusts, which is usually translated as "real estate investment trust fund". It originated in the United States and has a history of more than 50 years. Currently, more than 40 countries and regions have issued REITs products.

The emergence of REITs is mainly to facilitate small and medium investors to participate in the investment of large real estate projects, so as to share the rental, operating income and asset appreciation gains of these projects. Simply put, investors buying equity-listed REITs that are publicly listed are similar to buy stocks in listed companies. As a listed company, REITs will use the funds raised from the issuance of stocks (accurately called trust units) to purchase completed real estate (such as offices, commercial real estate, residential, logistics real estate, industrial land, etc.) or infrastructure projects (such as roads and bridges, fee-based projects such as water, electricity, gas, sewage treatment, etc.), and then obtain rental, charging and other income through leasing, management, operation, and even renovation, and return more than 90% of the profits to the "shareholders" in the form of dividends (which called "Trust Unit Holder").

The main highlights of the Chinese version of the REITs pilot

From the establishment of the REITs special research groups of the People's Bank of China, the China Securities Regulatory Commission and the China Banking and Insurance Regulatory Commission in 2007, and the issuance of the "Notice", the pilot of publicly funded REITs has officially started. It can be described as " Sword 10 Years". And the main points of this time are as follows:

1. REITs limited to underlying assets as infrastructure projects, and REITs with real estate projects as underlying assets are not within the scope of this pilot;

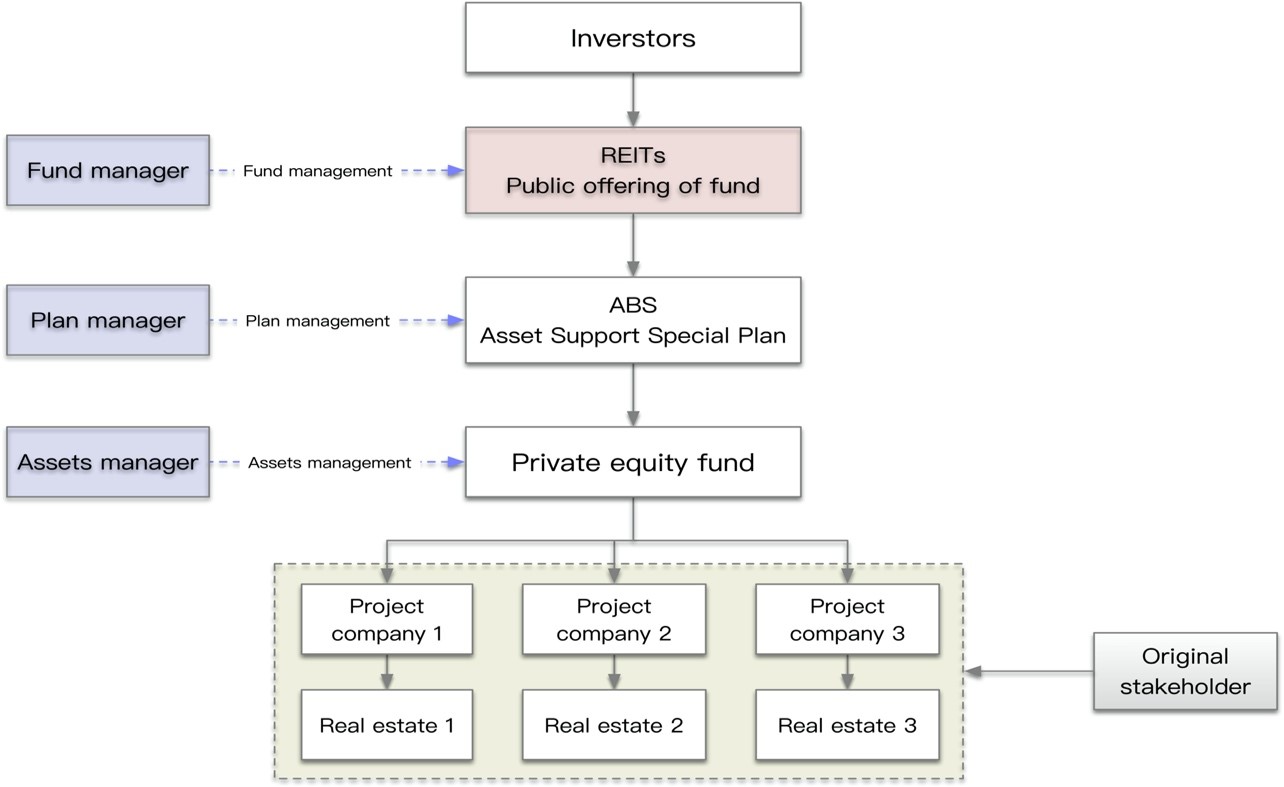

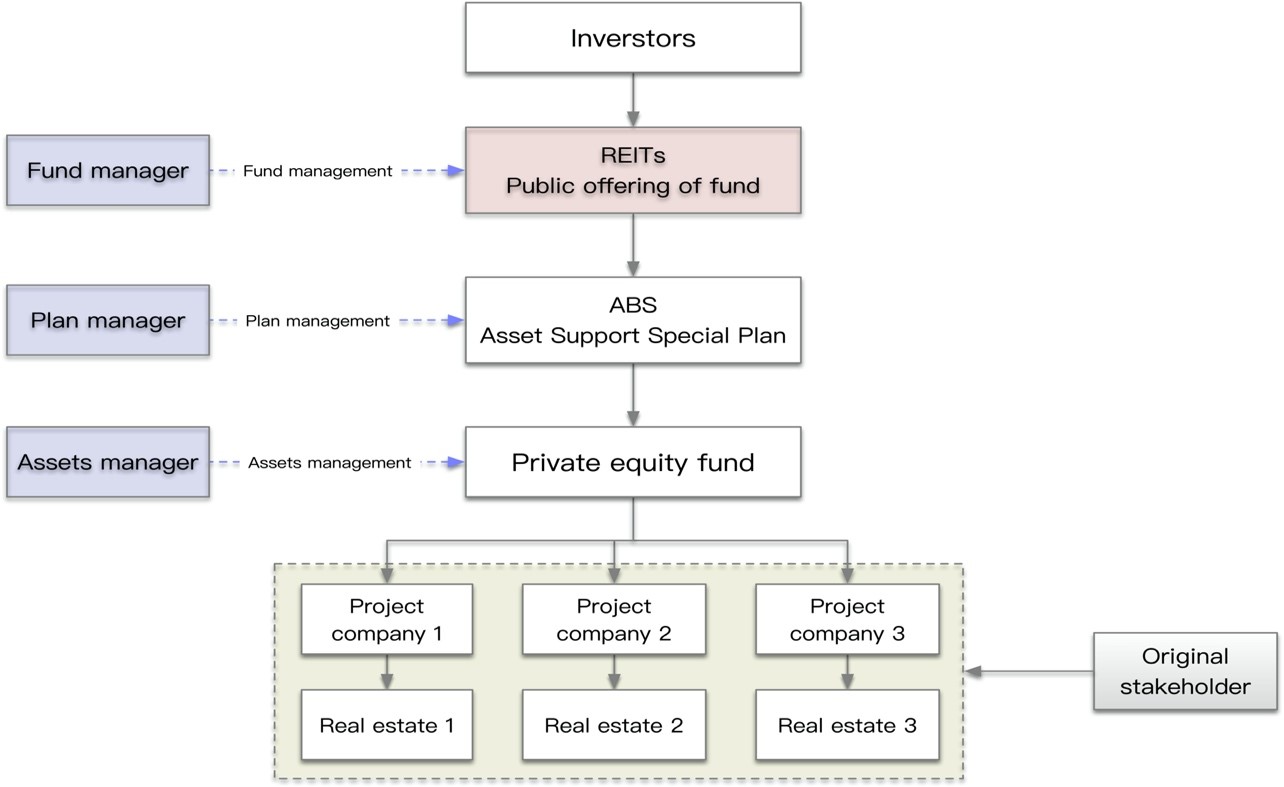

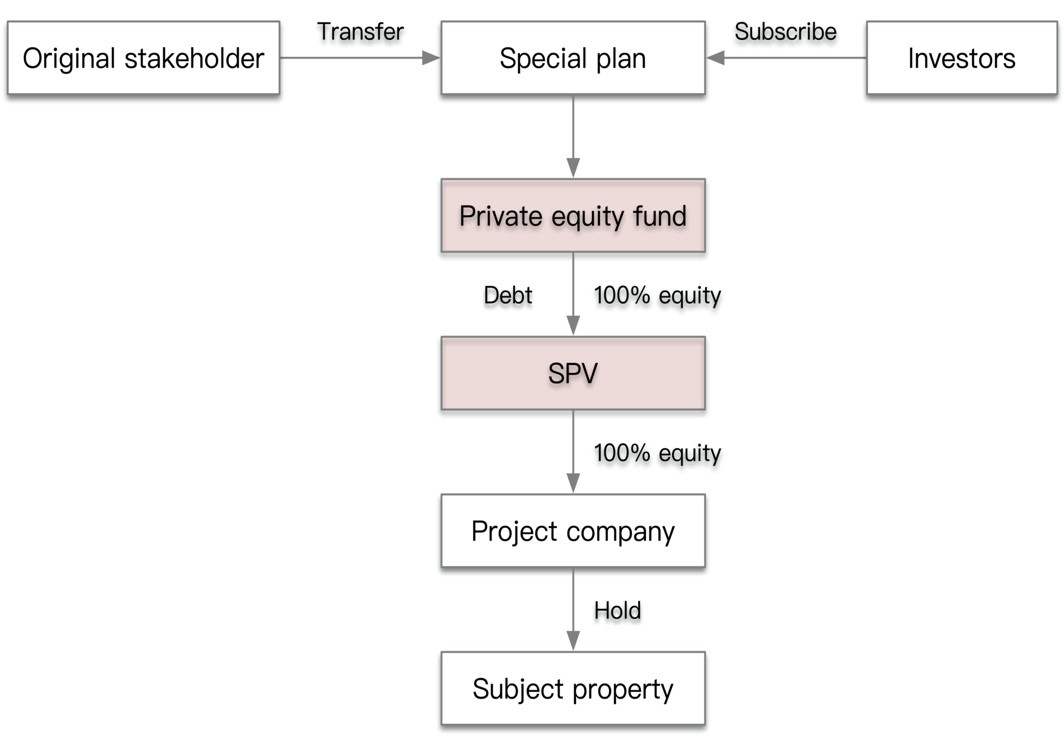

2. The REITs in the pilot program currently intend to use the " public offering of fund + single infrastructure asset-backed securities (ABS)" model (based on the "Securities Investment Fund Law" in China, fund assets should be used for the following investments: 1. Listed stocks and bonds; 2. Other securities and their derivatives as prescribed by the securities regulatory authority under the State Council. (As shown below);

3. The pilot program did not mention any special tax arrangements.

Tax considerations in the proposed link of REITs

In the construction of REITs, there are usually restructuring end, fund end, special plan end, etc. This article only briefly describes the most critical reorganization transaction arrangements as a background introduction. On the restructuring side, there are generally three major steps: one is stripping assets and setting up carriers, the other is special asset restructuring, and the third is three steps to build weak capital structure.

1. Strip assets off and set up carriers

One goal to be achieved during the reorganization phase is to obtain a net project company.

1) The only asset of the project company is the real estate required by REITs;

2) There are no other liabilities under the project company. Apart from the debts to be issued to them by the REITs special plan, there are no other liabilities.

The specific steps include:

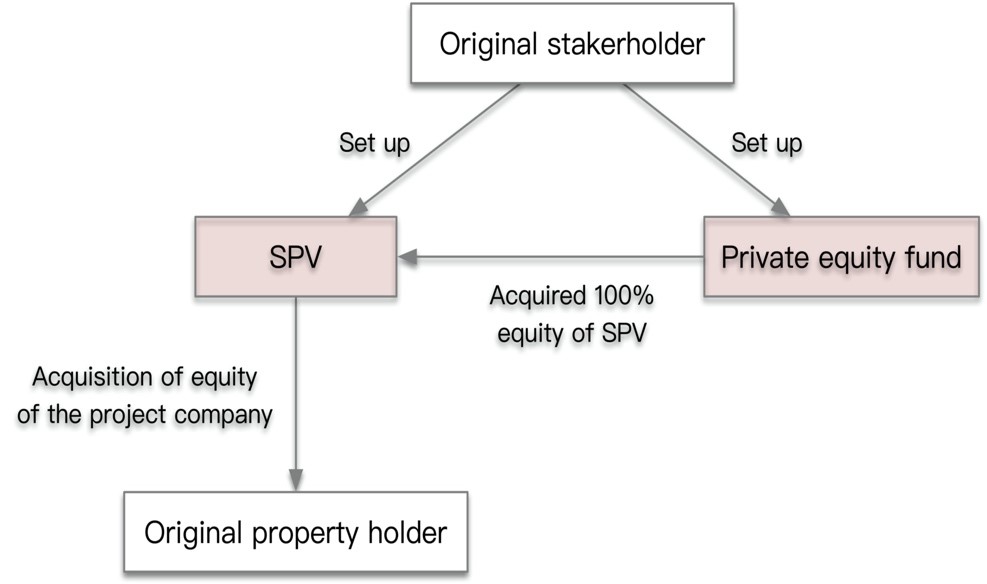

1. Divestment of assets: the divestiture of real estate required by REITs, that is, transfer to a net-shell project company;

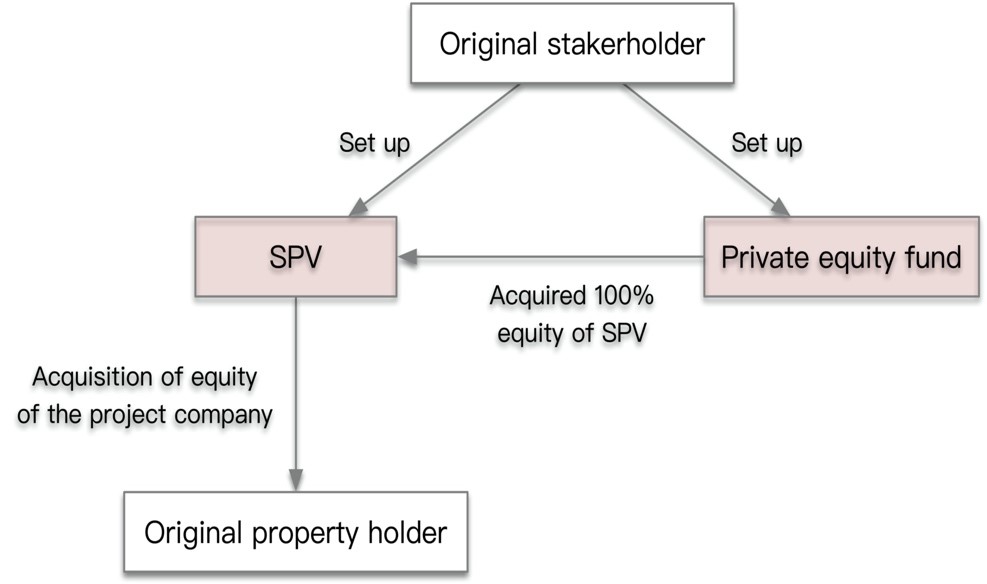

2. Establishment of acquisition entity 1: establishment of SPV, such as a special purpose company;

3. Establishment of acquisition entity 2: establishment of private equity funds.

2. Special reorganization

Before reorganization:

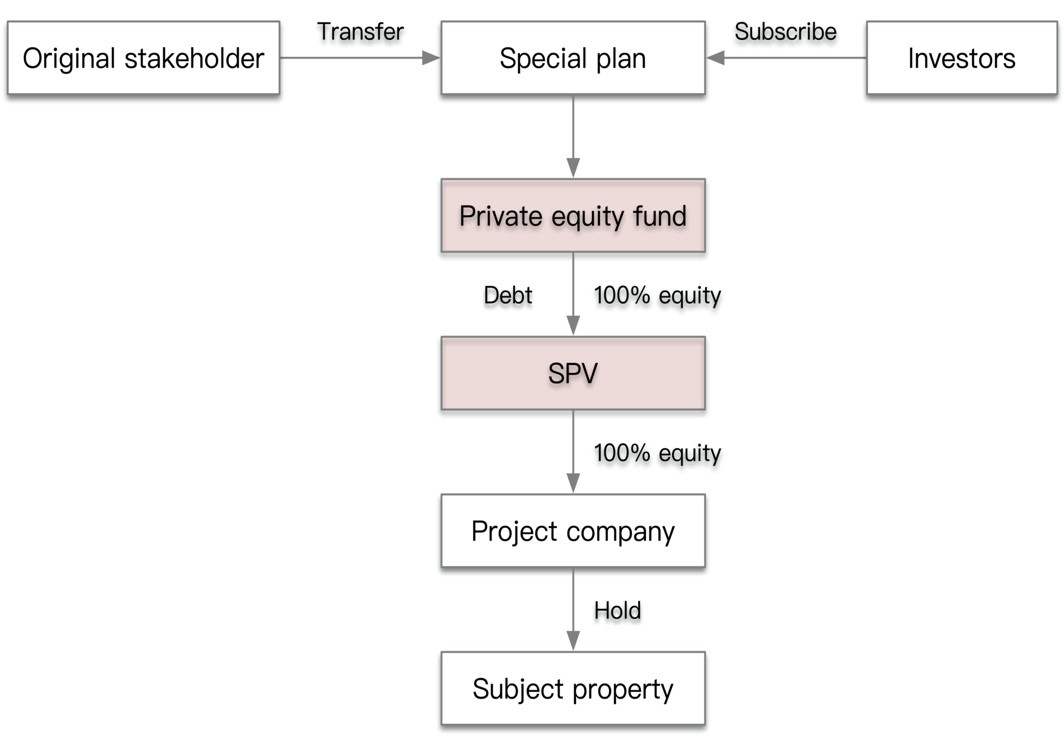

After reorganization:

Here, the taxes involved include:

(1) Value-added tax (transferor)

If the real estate is acquired on April 30, 2016:

1) Self-construction: The transferor can choose to apply the simple tax calculation method, that is, to use all the obtained price and extra-price expenses as sales, calculate and pay VAT at a 5% collection rate;

2) Non-self-built: The transferor can choose to apply the simple tax calculation method, that is, the balance after deducting the original price of the real estate purchase or the price at the time of obtaining the real estate is the sales amount, which is calculated at the 5% collection rate.

(2) Corporate income tax (transferor)

Generally, enterprise income tax is paid at 25%.

(3) Land value added tax (transferor)

Taxation is based on value added and is calculated at a progressive tax rate of 30% to 60%:

1) The value-added amount does not exceed 50% of the deducted item amount, and the land value-added tax amount = value-added amount × 30%;

2) The value-added tax exceeds 50% of the deducted project amount, and does not exceed 100% = value-added tax ×40%-deducted project amount × 5%

3) The value-added tax exceeds 100% of the deducted project amount and does not exceed 200% = value-added tax ×50%-deducted project amount × 15%

4) Land value-added tax that exceeds 200% of the deducted project value = value-added amount × 60%-deducted project amount × 35%

(4) Deed tax (transferee)

Generally, the payment is calculated at 3% to 5% of the transaction price, which is calculated according to the deed tax rate applicable to the location.

(5) Stamp duty (transferor and transferee)

Both parties to the contract (property transfer document) pay stamp tax at five ten thousandths of the transaction price.

In view of the above tax implications, it is important to consider how to use the current tax preferential policies and personalized tax planning arrangements to minimize the tax costs which include:

1. Corporate income tax: if a reorganization plan that can defer tax payment is designed based on special tax treatment;

2. Land value-added tax: two fair value assessments of the real estate divestiture link and the future transfer link;

3. Value-added tax: the whole asset transfer is not subject to VAT;

If any.

3. Build the Weak Capital structure

What needs to be realized here is the construction of a debt, and the realization of the Weak Capital in accordance with the 2: 1 debt-to-right ratio, the purpose is to achieve a pre-tax deduction of interest income tax, reduce tax payment, that is, the structure of Weak Capital.

At present, the pilot policy for infrastructure REITs has just been launched, and the relevant guidelines (for trial implementation) are still in the stage of soliciting opinions. With the continuous improvement of future supervision and related regulations, it may lead to further adjustments in transactions and product structure. For the follow-up policy of publicly funded REITs, we will wait and see on the special tax level and will update it in time.

![]() Home

Home

![]() Knowledge

Knowledge

![]() China

China ![]() Foreign Investment in China

Foreign Investment in China ![]() Benefits and Incentives

Benefits and Incentives ![]() REITs, New Promoters of Infrastructure, but Follow-up Policies will be Even More Anticipated

REITs, New Promoters of Infrastructure, but Follow-up Policies will be Even More Anticipated