|

(1) |

Categorize any recently acquired depreciable assets that have been put into use during the fiscal year according to their respective MACRS classes; |

|

(2) |

Determine MACRS conventions; |

|

(3) |

Calculate "regular" MACRS depreciation (both first-year assets and assets placed in service in prior periods). |

|

|

(1) |

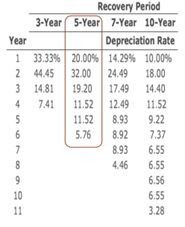

Half-year (HY) The cost of property in the 3-, 5-, 7-, and 10-year classes is recovered using the 200-percent declining-balance method, switching to the straight-line method in the year when that maximizes the deduction (IRC Section 168(b)(1)). HY is general rule: The general rule is that all assets are placed in service at the half-year regardless of when they were actually placed in service. Thus, for a calendar-year taxpayer, all assets are treated as placed in service on 7/1. |

|

(2) |

Mid-quarter (MQ) The cost of 15- year and 20-year property is recovered using the 150% declining balance method, switching to the straight-line method to maximize the deduction (IRC Section 168(b)(2)). MQ is exception: If more than 40% of assets by value subject to HY/MQ were placed in service in 4Q (10/1–12/31 for calendar year taxpayers), the MQ convention applies (not HY). |

|

(3) |

Mid-month (MM) The cost of 27.5- year (residential) and 39-year (non-residential) real property is recovered using the straight-line method. Assets are treated as placed in service in the middle of the month in which they were actually placed in service. |

|

Disclaimer All information in this article is only for the purpose of information sharing, instead of professional suggestion. Kaizen will not assume any responsibility for loss or damage. |