CFC Regulation in Taiwan- Company

With the upcoming deadline of special law of repatriated fund within the last two years till now (the law will be expired on August.), CFC regulation is about to come on the heels of it in 2020 by the arrangement of Ministry of Finance in Taiwan. Hundreds of businessmen in Taiwan who preferred to register their companies in BVI or Cayman Islands and invested firms in other countries is going to face an influential effect shortly.

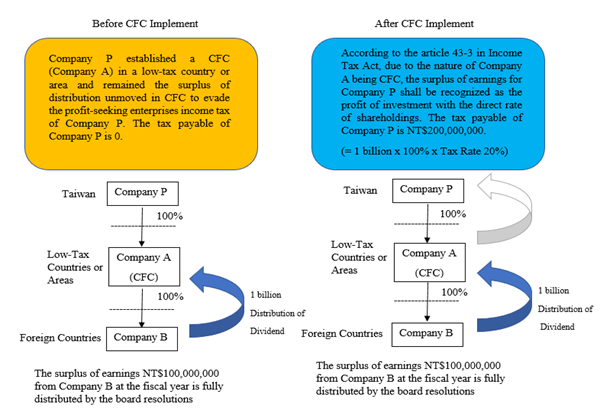

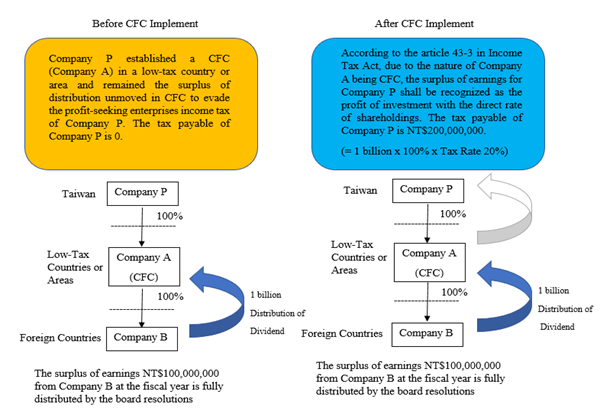

The purpose of Controlled Foreign Company (Here referred to as CFC) regulation is to avoid profit-seeking enterprise, which established its company in low-tax burden country without any practical business activity via CFC, evading the tax payable with the practical control or shares to get away with the policy of surplus distribution of the company in Taiwan. Therefore, the policy to curb tax evasion promulgated at the article 43-3 in Income Tax Act was established officially on 27/07/2016 to balance the entire regulation of taxation.

For individuals or enterprises with the holding of shares more than 50% of oversea companies in low-tax rate countries (Profit-seeking enterprises income tax rate less than 14%) will be applied to the practical principal of taxation regulated by Taiwan Taxation Bureau. That is, the profit of investment from these virtual companies will be recognized as the oversea profit of domestic enterprise. Here is the comparison of before-and-after implement of CFC regulation as below:

To whom meet one of the following conditions is able to be exempted from the regulation of CFC regulation:

-

CFC with the practical business activities in its located country or area.

-

The amount of surplus earnings from one individual CFC is under NT$7,000,000, but if the total amount of earnings with losses from such CFC is more than NT$7,000,000, the CFC still have to comply with CFC regulation to pay taxes.

Nevertheless, a prevalent misunderstanding is that an oversea company with an office and labors in that country can be counted as practical business activity to evade the regulation of CFC regulation, but the consequence of this action make the company face the punishment of recovery of overdue tax. In accordance with the examining directions regulated by Revenue Service Office in Taiwan, oversea companies shall meet the following requirements for exemption:

-

The proof of hiring local employees, payroll and involving business affairs in the company. The company secretary and trust company cannot be counted as local employees.

-

The proof of ownership or rental of local real estate and utility bill of such estate. The local post box is not allowed.

-

The unearned income from profit of investment, dividend, interest, and rental income is under 10% of total income.

In the circumstance of being CFC, the company shall submit the following documents in the declaration of individual income tax:

-

The structure of company and related party, shareholdings in the fiscal closing date, or the amount and rate of holdings of capital.

-

A financial statement certificated by a certified accountant in the designated country or republic of China. If other documents certified by the local competent authorities can prove the authenticity of the financial statement, such documents are able to be the substitute of the certificated financial statement by certified accountant.

-

Loss carryforwards statement prior 10 years before the date of CFC establishing.

-

Recognized CFC investment profit statement

-

Certificate of tax payment issued by the foreign ROC competent authority, or the authorities recognized by ROC government for those who converted into CFC and applied to the oversea rules of tax offset.

-

The agreement of shareholder or certificate of shareholder resolutions.

-

Certificate of loss recovery, consolidation, bankruptcy, or liquidation promulgated by ROC embassies or other authorities recognized by ROC government.

It is added that if a foreign company is regulated under CFC regulation and its Place of Effective Management (PEM) is in Taiwan, such company shall follow the PEM regulations priorly, instead of CFC.