![]() Home

Home

![]() Knowledge

Knowledge

![]() US

US ![]() US Taxation

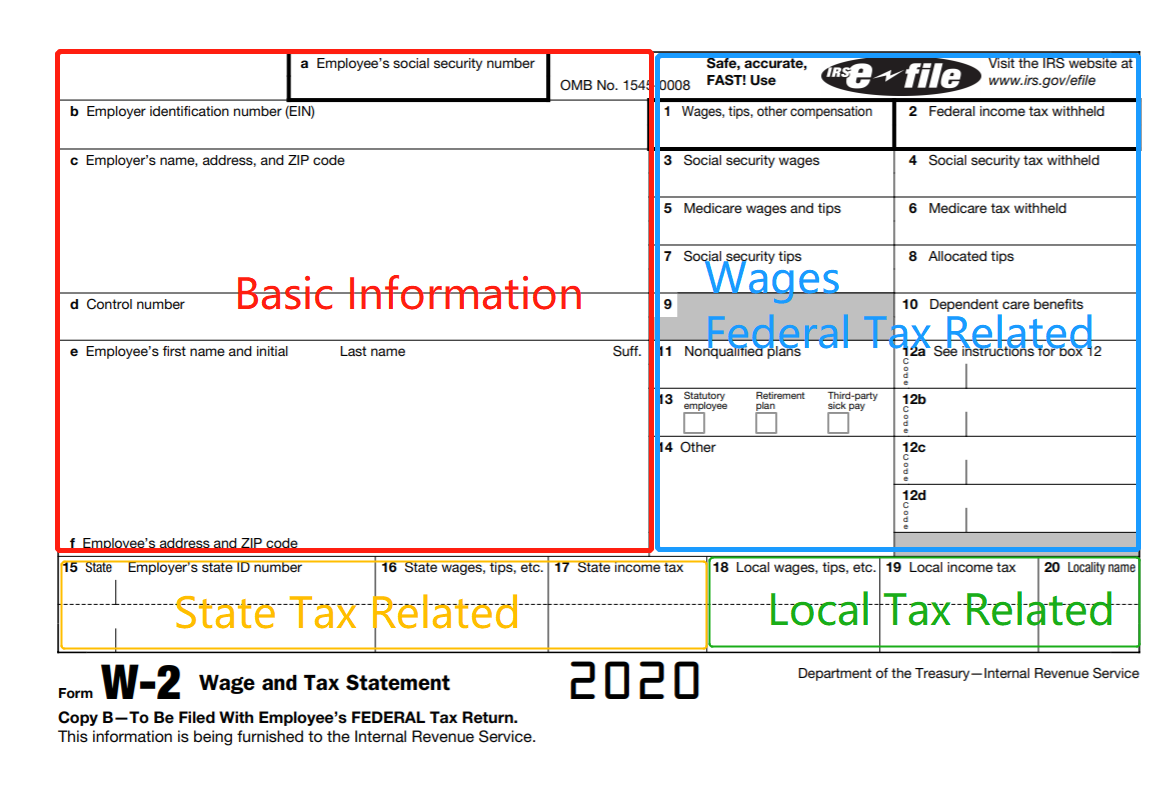

US Taxation ![]() U.S. Individual Income Tax - Part 3 How to Read and Understand Form W-2?

U.S. Individual Income Tax - Part 3 How to Read and Understand Form W-2?

|

(1) |

Box 1 Wages, Tips, Other Compensation Box 1 reports your total taxable wages or salary. The number include any taxable compensation such as taxable insurance paid by employer, but not include any pre-tax benefits such as savings contributions to a 401(k) plan. |

|

(2) |

Box 2 Federal Income Tax Withheld Box 2 reports how much your employer withheld from your pay checks for federal income taxes. This number is calculated based on the number in Box 1 and certain tax rate. |

|

(3) |

Box 3 Social Security Wages Box 3 is the wage base for Box 4 calculation. It reports the total amount of your wages that are subject to Social Security tax. This tax is assessed on wages up to $132,900 as of tax year 2019. This "wage base" is adjusted annually to adapt for inflation, you can find latest guideline on IRS website. |

|

(4) |

Box 4 Social Security Tax Withheld Box 4 reports the total amount of Social Security taxes withheld from your pay checks. The figure shown in Box 4 should be wage base (Box 3) times flat rate of 6.2%. |

|

(5) |

Box 5 Medicare Wages and Tips Box 5 reports the amount of your wages that are subject to the Medicare tax. There's no maximum wage base for Medicare. |

|

(6) |

Box 6 Medicare Tax Withheld Box 6 reports how much in taxes was withheld from your pay check for the Medicare tax, which is a flat tax rate of 1.45% of your total Medicare wages as of the tax year. If your medical wages exceed a certain level, you may be subject to Additional Medicare Tax, an additional .9%. |

|

(7) |

Box 7 Social Security Tips Box 7 shows any tip income you've reported to your employer. The amount from Box 7 is already included in Box 1. |

|

(8) |

Box 8 Allocated Tips Box 8 reports any tip income that was allocated to you by your employer. This amount is not included in the wages that are reported in Boxes 1, 3, 5, or 7. Instead, you must add your allocated tips to your taxable wages on line 1 of your Form 1040, and you must calculate your Social Security and Medicare taxes including this tip income using IRS Form 4137. |

|

(9) |

Box 10 Dependent Care Benefits Box 10 reports any amounts you might have been reimbursed for dependent care expenses through a flexible spending account, or the dollar value of dependent care services provided to you by your employer. Reimbursements and services under $5,000 aren't taxable, but any amount over $5,000 should be reported as taxable wages in Boxes 1, 3, and 5. Dependent care benefits are reported on Form 2441. |

|

(10) |

Box 11-14 Box 11-14 are information only. The amounts in Box 11-14 are already included as taxable wages in Box 1.10 |

|

Disclaimer All information in this article is only for the purpose of information sharing, instead of professional suggestion. Kaizen will not assume any responsibility for loss or damage. |