|

(1) |

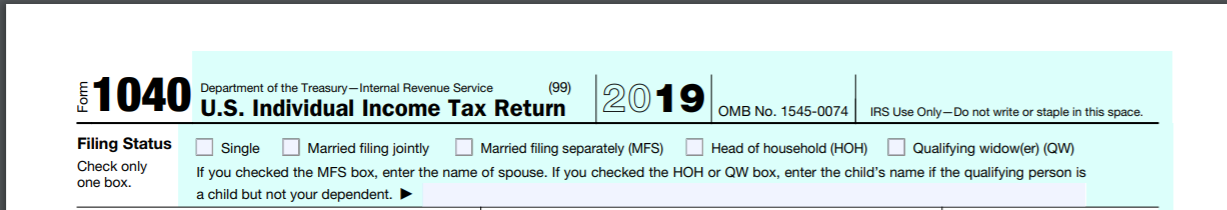

Single Filing Status If on the last day of the year, you are unmarried or legally separated from your spouse under a divorce or separate maintenance decree and you do not qualify for another filing status. |

|

(2) |

Married Filing Jointly Filing Status You are married and both you and your spouse agree to file a joint return. (On a joint return, you report your combined income and deduct your combined allowable expenses.) |

|

(3) |

Married Filing Separately Filing Status You must be married. This method may benefit you if you want to be responsible only for your own tax or if this method results in less tax than a joint return. If you and your spouse do not agree to file a joint return, you may have to use this filing status. |

|

(4) |

Head of Household Filing Status You must meet the following requirements: 1. You are unmarried or considered unmarried on the last day of the year. 2. You paid more than half the cost of keeping up a home for the year. 3. A qualifying person lived with you in the home for more than half the year (except temporary absences, such as school). However, your dependent parent does not have to live with you. |

|

(5) |

Qualifying Widow(er) with Dependent Child Filing Status The year of death is the last year for which you can file jointly with your deceased spouse. You may be eligible to use qualifying widow(er) with dependent child as your filing status for two years following the year of death of your spouse. The surviving spouse must pay over half the cost of maintaining a household where a dependent child lives for the whole taxable year. |

|

|

Disclaimer All information in this article is only for the purpose of information sharing, instead of professional suggestion. Kaizen will not assume any responsibility for loss or damage. |