Hong Kong Taxation

The HKSAR Government Proposes to Reduce the Profits Tax

for the Year of Assessment 2022/23

On 22 February 2023, the Financial Secretary of Hong Kong, Mr. Paul Chan Mo-po, delivered 2023-24 Budget. He proposed a one-off reduction of profits tax for the year of assessment 2022/23 by 100%, subject to a ceiling of HK$6,000 per case.

This concessionary measure is applicable for the profits tax for the year of assessment 2022/23, that is, for the accounting year ended within the period from 1 April 2022 to 31 March 2023. No additional application for this proposed concessionary measure is required. Taxpayers should file their profits tax returns as usual. Although this proposed concessionary measure is subject to review and approval by the Legislative Council of Hong Kong, it will generally be adopted based on experience.

-

Hong Kong's Tax System

Hong Kong adopts a territorial source principle of taxation. Only profits arise in or are derived from Hong Kong are taxable here. Profits sourced elsewhere are not subject to Hong Kong Profits Tax. The system itself is very clear and simple, and the tax rates are relatively low.

The Inland Revenue Department (“IRD”) charges tax on profits which arise in or are derived from a trade, profession, or business carried on in Hong Kong. Profits Tax is only charged on profits which arise in or are derived from Hong Kong. In simple terms this means that a Hong Kong company which derives profits from another place outside Hong Kong is not required to pay tax in Hong Kong on those profits.

-

Scope of Charge of Profits Tax in Hong Kong

Under the Inland Revenue Ordinance, a person is chargeable to Profits Tax under the following conditions:

1) he carries on a trade, profession or business in Hong Kong;

2) the trade, profession or business derives profits; and

3) the profits arise in or are derived from Hong Kong.

Persons, including corporations, partnerships, trustees and bodies of persons carrying on any trade, profession or business in Hong Kong are chargeable to tax on all profits (excluding profits arising from the sale of capital assets) arising in or derived from Hong Kong from such trade, profession or business. Therefore, there is no distinction made between residents and non-residents. A resident may therefore derive profits from abroad without suffering tax; conversely, a non-resident may suffer tax on profits arising in Hong Kong. The question of whether a business is carried on in Hong Kong and whether profits are derived from Hong Kong is determined by facts. No tax is levied on profits arising abroad, even if they are remitted to Hong Kong.

-

Hong Kong's Two-tiered Profits Tax Rates Regime

In order to enhance the international competitivity and promote economic development, the HKSAR Government implemented the two-tiered profits tax rates regime in which based on maintenance of original profits tax rate for the corporations at 16.5% and profits tax rate for the unincorporated businesses (i.e. partnerships and sole proprietorships) at 15%. The two-tiered profits tax rates regime will be applicable to any year of assessment commencing on or after 1 April 2018. Under the two-tiered profits tax rates regime, the profits tax rate for the first HK$2 million of assessable profits will be lowered to 8.25% for corporations and 7.5% for unincorporated businesses. Assessable profits above HK$2 million will continue to be subject to the tax rate of 16.5% for corporations and standard rate of 15% for unincorporated businesses.

In simple terms, this means that Hong Kong profits tax rates can be classified into 3 main categories: one is applicable to corporations at 16.5%, another one is applicable to unincorporated businesses at 15% and the last one is applicable to the taxpaying entities which qualify for the two-tiered profits tax rates.

For details, please refer to the Hong Kong profits tax rate tabl as below.

Table 1: Profits tax rates applicable to corporations

|

Types of Tax

Rates

|

Year of

Assessment

|

Tax Rate

|

|

Corporation

rate

|

2008/09

onwards

|

16.5%

|

|

Two-tiered rates

|

2018/19

onwards

|

Assessable

profits up to HK$2,000,000

|

8.25%

|

|

Any part of

assessable profits over HK$2,000,000

|

16.5%

|

Table 2: Profits tax rates applicable to unincorporated businesses

|

Types of Tax

Rates

|

Year of

Assessment

|

Tax Rate

|

|

Standard

rate

|

2008/09

onwards

|

15%

|

|

Two-tiered rates

|

2018/19

onwards

|

Assessable

profits up to HK$2,000,000

|

7.5%

|

|

Any part of

assessable profits over HK$2,000,000

|

15%

|

IRD will issue the profits tax returns for 2022/23 in bulk to corporations and partnership businesses of which fall within the “active” category in the Department on the first week of April 2023. In respect to the operating statuses of corporations and partnership businesses, taxpayers who receive tax returns should complete the filing of profits tax returns and settle corresponding profits taxes by the specified due date. If taxpayers do not receive profits tax returns, but the company commences or recommences to earn assessable profits (before the set-off of any loss brought forward), then the company must inform the IRD in writing within 4 months after the end of basis period (the accounting period) for that year of assessment.

In view of various accounting periods adopted by taxpayers, basis periods reported in the tax returns will be different accordingly. For instance, the year ended date of Kaizen CPA Limited is 31 March during the relevant year, then the basis period of our Company for the year of assessment 2022/23 is covered from 1 April 2022 to 31 March 2023. If our Company satisfies the relevant conditions, then two-tiered profits tax rates can be applicable to our Company.

-

Hong Kong's Tax Reduction Measures Implemented Over Years

In order to promote economic development, support small and medium enterprises and implement Hong Kong governing philosophy of leaving wealth with the people, the HKSAR Government proposes to reserve part of fiscal surplus annually in annual fiscal budget for the expenditure on tax reduction measures. These concessionary measures obtained the passage by the Legislative Council in the past years. Our Company list out the profits tax reduction implemented by the IRD over recent seven years as below, as for our current and potential customers’ reference uses.

Table 3: Tax reduction implemented by IRD over recent years (year of assessment 2016/17 onwards)

|

Year of

Assessment

|

Tax

Reduction

|

|

2022/23

|

100% of profits tax is waived, subject to

a ceiling of HK$6,000 per case (Legislative amendments are required for

implementing the proposed measures)

|

|

2021/22

|

100% of profits tax is waived,

subject to a ceiling of HK$10,000 per case

|

|

2020/21

|

100% of profits tax is waived,

subject to a ceiling of HK$10,000 per case

|

|

2019/20

|

100% of profits tax is waived,

subject to a ceiling of HK$20,000 per case

|

|

2018/19

|

100% of profits tax is waived, subject to

a ceiling of HK$20,000 per case

|

|

2017/18

|

75% of profits tax is waived, subject to a

ceiling of HK$30,000 per case

|

|

2016/17

|

75% of profits tax is waived, subject to a

ceiling of HK$20,000 per case

|

-

Illustrative Examples of the Computation of Hong Kong Profits Tax

Example 1

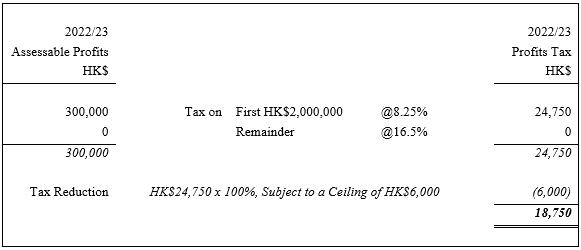

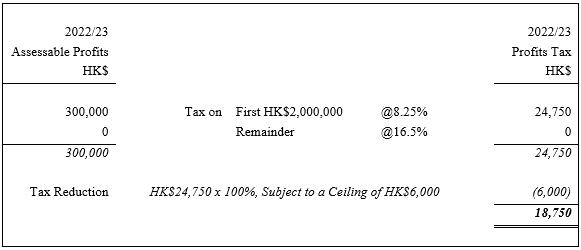

Corporation A has assessable profits HK$300,000 for the year of assessment 2022/23. Assuming that the corporation fulfills the conditions applying the two-tiered profits tax rates regime and its assessable profit is below HK$2,000,000, its assessable profits should be charged at 8.25% and its profits tax should be calculated as HK$24,750. Under the proposed tax reduction measures for the year of assessment 2022/23, tax reduction of 100% of the profits tax payable for 2022/23 (i.e. HK$24,750 x 100% = HK$24,750) can be obtained, subject to a ceiling of HK$6,000. Therefore, its final tax for 2022/23 should be HK$18,750, which should be calculated as follows:

Example 2

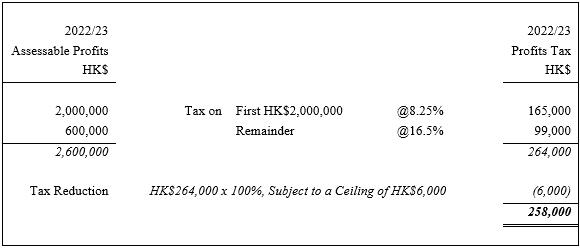

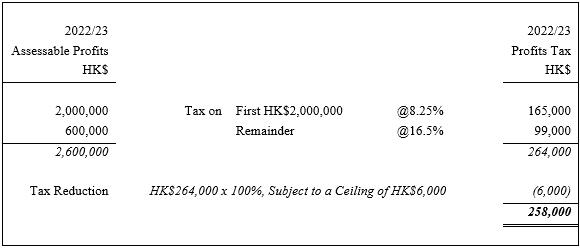

Corporation B has assessable profits HK$2,600,000 for the year of assessment 2022/23. Assuming that the corporation fulfills the conditions applying the two-tiered profits tax rates regime, assessable profits of first HK$2,000,000 should be charged at 8.25% and the remainder of HK$600,000 should be charged at 16.5%, and its profits tax should be calculated as HK$264,000. Under the proposed tax reduction measures for the year of assessment 2022/23, tax reduction of 100% of the profits tax payable for 2022/23 (i.e. HK$264,000 x 100% = HK$264,000) can be obtained, subject to a ceiling of HK$6,000. Therefore, its final tax for 2022/23 should be HK$258,000, which should be calculated as follows:

Example 3

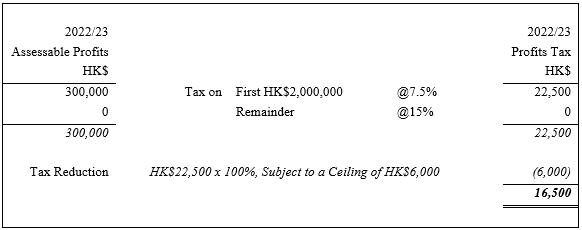

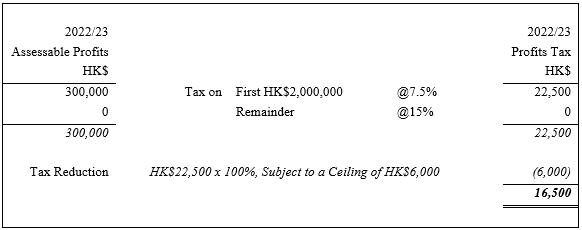

Partnership C has assessable profits HK$300,000 for the year of assessment 2022/23. Assuming that the partnership fulfills the conditions applying the two-tiered profits tax rates regime and its assessable profit is below HK$2,000,000, its assessable profits should be charged at 7.5% and its profits tax should be calculated as HK$22,500. Under the proposed tax reduction measures for the year of assessment 2022/23, tax reduction of 100% of the profits tax payable for 2022/23 (i.e. HK$22,500 x 100% = HK$22,500) can be obtained, subject to a ceiling of HK$6,000. Therefore, its final tax for 2022/23 should be HK$16,500, which should be calculated as follows:

Example 4

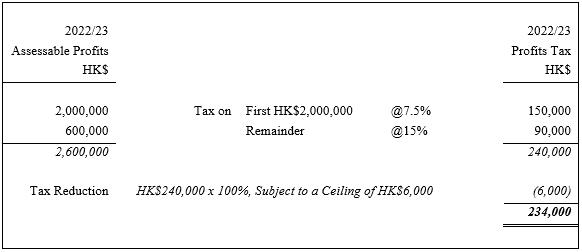

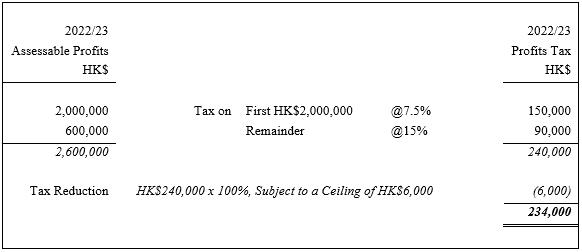

Partnership D has assessable profits HK$2,600,000 for the year of assessment 2022/23. Assuming that the partnership fulfills the conditions applying the two-tiered profits tax rates regime, assessable profits of first HK$2,000,000 should be charged at 7.5% and the remainder of HK$600,000 should be charged at 15%, and its profits tax should be calculated as HK$240,000. Under the proposed tax reduction measures for the year of assessment 2022/23, tax reduction of 100% of the profits tax payable for 2022/23 (i.e. HK$240,000 x 100% = HK$240,000) can be obtained, subject to a ceiling of HK$6,000. Therefore, its final tax for 2022/23 should be HK$234,000, which should be calculated as follows:

-

Application for the Exemption of Profits Tax Derived from Offshore Profits

Hong Kong adopts a territorial source principle of taxation. Only profits which arise in or are derived from Hong Kong are taxable here. Profits sourced elsewhere are not subject to Hong Kong Profits Tax. In simple terms, this means that profits derived from another place outside Hong Kong are not subject to profits tax in Hong Kong.

Under current tax system, when overseas companies or non-Hong Kong residents register companies in Hong Kong, they can proceed legal international trading and commercial activities with multiple advantages of Hong Kong, which include worldwide financial center, international free trade port and low tax burden.

All along, Hong Kong Inland Revenue Ordinance allows local Hong Kong companies to apply profits tax exemption for their offshore income. Further, taxpayers may apply to the Commissioner of the IRD for advance rulings, subject to provision of the Inland Revenue Ordinance. The IRD would review the application for the exemption of Hong Kong profits tax on offshore profits in a prudent and strict way in order to prevent any tax evasion. In order to avoid any risk on taxation issues and reduce the tax burden of enterprises, we suggest your Company to have a tax planning and obtain professional opinions from experienced professional tax advisors. You are always welcome to get a consultation with us.

In regard to the exemption of Hong Kong profits tax on offshore profits, our Company prepared a more detailed article for your perusal. Please visit our official website for further information: Introduction on Taxation of Hong Kong Companies Operating Offshore

Kaizen suggests you consult the professional advice of tax advisors before taking actions. Should you have any questions in relation to the proposals, please feel free to contact our CTAs in Hong Kong.

Benjamin HP Yen

Tax Partner

T: +852 2270 9768

E:

benjamin.yen@kaizencpa.com

Vicki Wong

Tax Planning Manageress

T: +852 2270 9725

E:

vicki.wong@kaizencpa.com![]() Home

Home

![]() Knowledge

Knowledge

![]() Hong Kong

Hong Kong ![]() Hong Kong Taxation

Hong Kong Taxation ![]() Profits Tax

Profits Tax ![]() The HKSAR Government Proposes to Reduce the Profits Tax for the Year of Assessment 2022/23

The HKSAR Government Proposes to Reduce the Profits Tax for the Year of Assessment 2022/23