![]() Home

Home

![]() Knowledge

Knowledge

![]() Other Jurisdiction

Other Jurisdiction ![]() Taxation

Taxation ![]() Oceania

Oceania ![]() Introduction to Individual Income Tax in Australia

Introduction to Individual Income Tax in Australia

|

1. |

Tax Year |

|

|

Australian tax year (financial year), is July 1 of the current year to June 30 of the following year. Within a tax year, both Australian tax residents and non-Australian tax residents should report to the ATO in accordance with their corresponding tax obligations. |

| 2. |

Principle of Taxation |

|

|

Australia is a high tax country that based on the principle of territoriality and nationality. According to the Australian tax law, all Australian tax residents must report to the ATO regardless of whether their income derives from within or outside Australia. Non-Australian Residents are also required to report income derived from Australia. |

|

3. |

Types of Taxable Income |

|

|

|

Australian tax law stipulated the following types of income the taxpayers need to declare: |

|

|

|

(1) |

Employment Income. Including the salaries and wages, bonus, dividends, allowances and subsidies and other income related to employment. |

|

|

(2) |

Super Pensions, Annuities and Government Payments |

|

|

(3) |

Investment Income. Including interest, dividend, rent and capital gains. |

|

|

(4) |

Business, Partnership and Trust Income |

|

|

(5) |

Other Income. Including insurance payments, discounted shares under employee share schemes, and prizes and awards. |

|

4. |

Australian Tax Residents and Non-Australian Tax Residents |

||

|

|

In the Australian tax system, the tax obligations, tax benefits and treatments of Australian tax residents and non-Australian tax residents are very different. The tax amount payable of non-Australian residents will be significantly higher than that of Australian tax residents. Therefore, judging whether an individual is an Australian tax resident and the different tax policies that distinguish Australian tax residents from non-Australian tax residents is the most basic and important prerequisite. |

||

|

|

(1) |

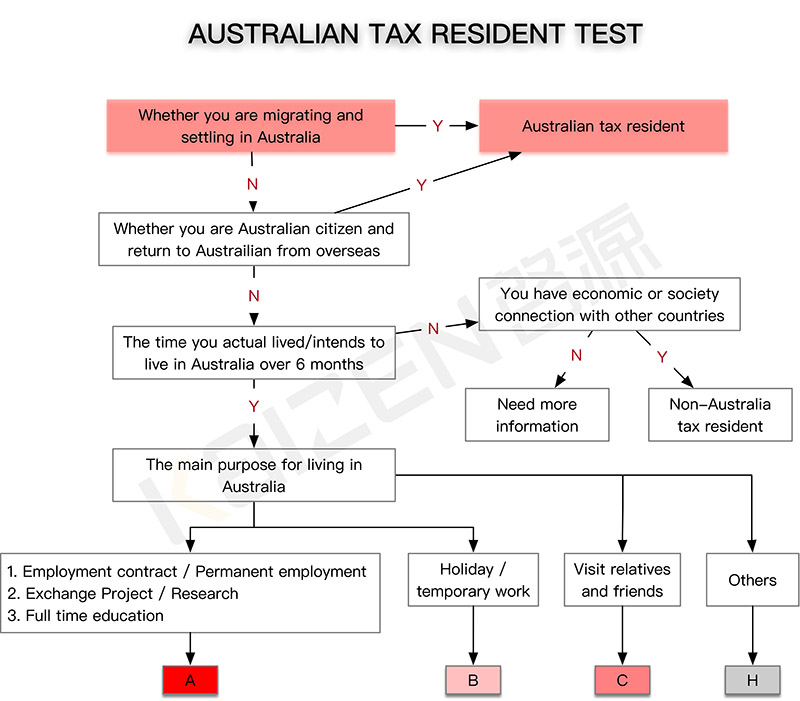

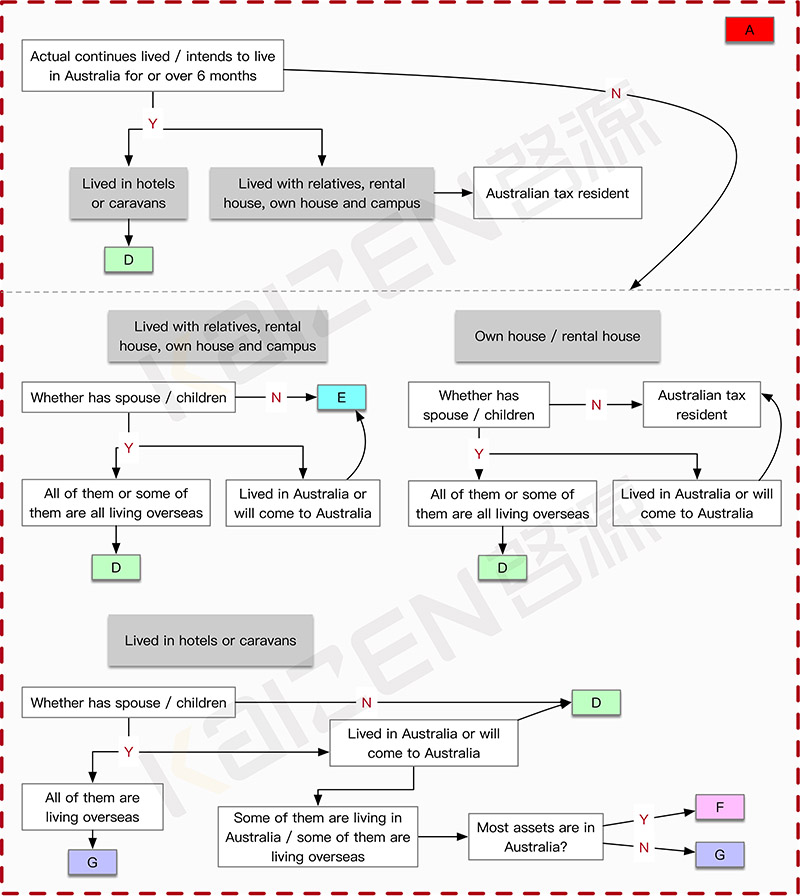

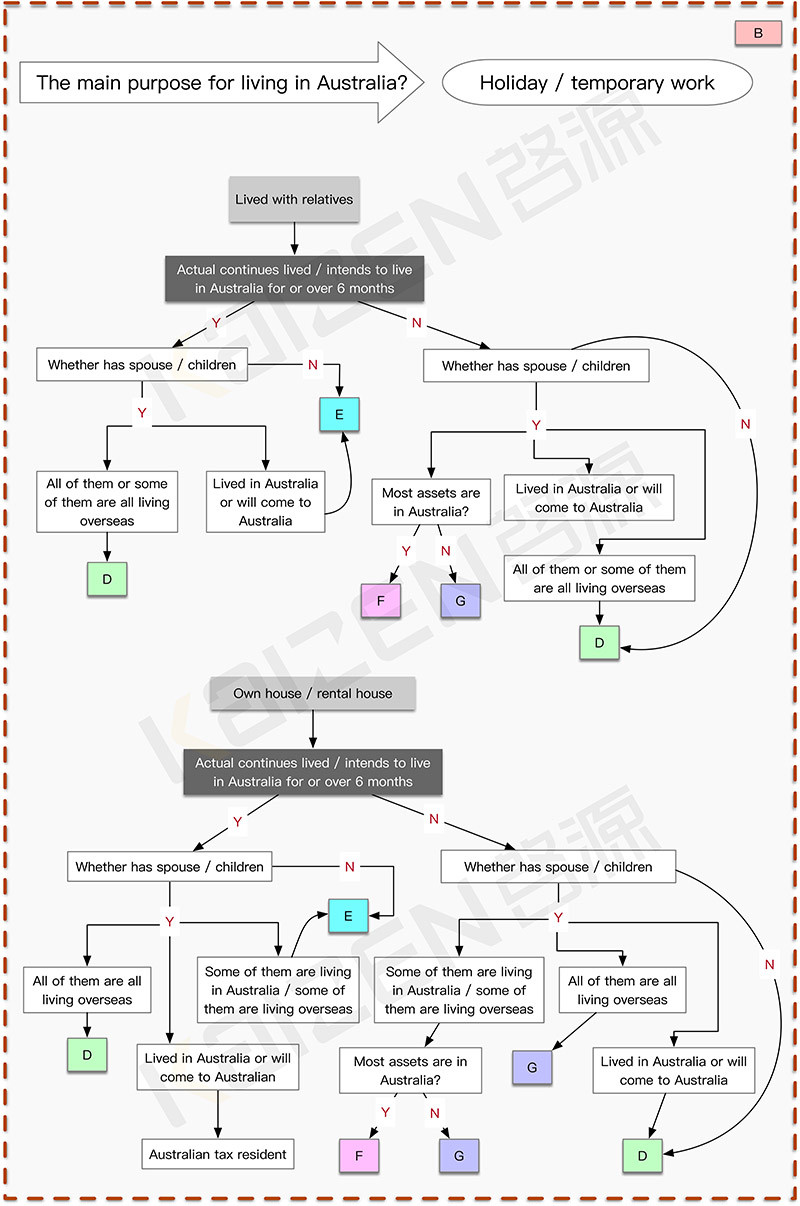

Identification of Australian Tax Residents Status As the ATO required the Australian tax residents declare all worldwide income earned both in Australia and internationally, such as employment income, business income, capital gains and other incomes. The definition of Australian tax residents defined by Australian government is a concept that difficult to understand clearly, even for the tax experts. Whether it holds Australian nationality or Australian permanent resident status, whether it has a tax file number in Australia, all these factors cannot determine the Australian tax resident status. This means that an individual may be considered as an Australian tax resident even if he does not have Australian nationality or Australian permanent resident status. The ATO has developed four tests to determine tax residency status, requiring taxpayers to be judged to be Australian tax residents as long as they satisfy any one of these tests. This is the judgment method stipulated by the ATO. In essence, the tax law itself does not clearly define these four test standards. |

|

|

|

|

(a) |

The Resides Test The resides test is the most important one. If a taxpayer's "habitual residence" is in Australia, he is considered an Australian tax resident. "Habitual residence" is not clearly defined in tax law. In practice, when assessing whether a taxpayer has a habitual residence, the ATO requires the taxpayer to report all relevant factors to them. The ATO conducts a comprehensive assessment of all relevant factors submitted by the taxpayer and judges whether the taxpayer is Australian tax resident. Relevant factors in the determination criteria include many items, general including:

It should be noted that meeting one or more of the relevant factors in the judgment criteria does not mean that the taxpayer will be judged as an Australian tax resident. The tax authority will comprehensively consider all factors to evaluate the tax resident status of the taxpayer. |

|

|

|

(b) |

The Domicile Test The domicile test requires that a taxpayer be deemed to be an Australian tax resident if the resident's usual residence (domicile) is in Australia, unless the ATO considers the taxpayer have a permanent place of abode outside Australia. The concepts of domicile and permanent place of abode are not clearly defined in tax law and can only be determined based on actual conditions. Generally, the place of domicile can be identified according to three methods:

The permanent place of abode outside Australia, is also a concept of case law. Generally, ATO will consider following factors when they judge whether the taxpayers have permanent place of abode outside Australia:

|

|

|

|

(c) |

The 183-day Test The 183-day test is a relatively easy test to determine the Australian tax resident status. It is mainly aimed at determining whether an individual who already resided in Australia is an Australian tax resident. Taxpayers who have lived in Australia for 183 days (six months) in a tax year (July 1 to June 30), whether continued or discontinued, will be judged to be Australian tax residents, unless it can be established that the "usual place of abode" is outside Australia or the taxpayer "has no intention to reside in Australia permanently". It can be noted that the usual place of abode in the 183-day test is different from the permanent residence in the resides test. A usual place of abode is a place in which a person adopts his habits and daily behaviour in a country (or region). For example, a taxpayer who has obtained a 12-month Australian working holiday visa and has a fixed residence outside Australia and the fixed residence has not been rented out while he is in Australia. During his time in Australia, he has visited many cities, and has not lived for more than two months in each city. He has only worked in Australia for 8 months in a tax year and travelled in Australia the rest of the time. The ATO believes that although he has been in Australia for more than 183 days in this case, his " usual place of abode " is outside Australia and does not meet the 183-day test. |

|

|

|

(d) |

The Commonwealth Superannuation Fund Test This test only applies to certain Australian Government employees or their relatives who are eligible to contribute to the Public Sector Superannuation Scheme (PSS) or the Commonwealth Superannuation Scheme (CSS). In this is the case, you (and your spouse and children under 16) are considered to be an Australia resident regardless of any other factors. |

|

|

(2) |

Identification of Non-Australian Tax Residents Status |

|

|

|

|

If an individual does not meet the four tests determined to be an Australian tax resident, but actually has income derived from Australian, in this case, he is judged to be a non-Australian tax resident. He does not need to report and pay taxes on their global income, only need to declare and pay taxes for the income derived from Australia. For non-Australian tax residents, there are no tax exemptions. |

|

|

|

(3) |

Conversion of Australian Tax Resident and Non-Australian Tax Residents |

|

|

|

|

The Australian tax year is from July 1 to June 30 of the following year. As the status of Australian tax residents is judged on the basis of the tax year, this means that the tax status of the same person in different tax years may be different. From a theoretical point of view, if a taxpayer is judged to be an Australian tax resident in a tax year and is judged to be a non-Australian tax resident in the next tax year, he may not need to be declared the taxes with the ATO. However, from ATO perspective, it is more inclined to rely on the Australian tax resident to determine that it will not be returned to become an Australian resident for a longer period of time after becoming a non-Australian tax resident. If a taxpayer is judged to be an Australian tax resident in a tax year and is judged to be a non-Australian tax resident in the next tax year, the taxpayer can be changed to non-Australia tax resident and does not need to declare taxes to the ATO in the future tax years only if he does not meet the conditions for becoming an Australian tax resident after it is determined, and submit the final return to the ATO. What needs attention and caution is that the submission of the final return declares that the taxpayer will never again become an Australian tax resident. Therefore, for some individuals who temporarily leave Australia, although the conditions for Australian tax residents have not been met, they may still be regarded as Australian tax residents for a period of time and still need to submit tax return to the ATO. |

|

|

5. |

Tax Rate |

|||||||||||||||||||

|

|

According to Australian tax laws, the calculation of Australian individual income tax uses an "Excessive Progressive Tax Rate". There are different individual income tax rates for Australian tax residents and non-Australian tax residents, children and working holiday makers. |

|||||||||||||||||||

|

|

(1) |

Australian Tax Residents Tax Rate Table 1: Australian Tax Residents Individual Tax Rate 2019/20

|

||||||||||||||||||

|

|

(2) |

Non-Australian Tax Residents Tax Rate Table 2: Non-Australian Tax Residents Individual Income Tax Rate 2019/20

|

||||||||||||||||||

|

|

(3) |

Children and Working Holiday Makers Tax Rate The ATO also stipulated the individual income tax rates applicable to Australian tax residents and non-Australian tax residents, as well as the tax rates applicable to minors under the age of 18 (children) and working holiday makers. for the taxpayers who are children or working holiday makers. Special tax rates (higher rate than an audit) applied to children who receive unearned income (for example investment income). Table 3: Working Holiday Makers Individual Income Tax Rate 2019/20

|

||||||||||||||||||

|

6. |

Expense Deductions |

||||||||||||||||||||||||||||||

|

|

When a taxpayer completing his tax return, he is entitled to claim deductions for some expenses, including:

It can be noted that the premise of claiming deduction of work-related income is that such expenses are directly related to earning of income, the taxpayers must have spent the money themselves and weren’t reimbursed. Including:

|

||||||||||||||||||||||||||||||

| 7. |

Basic Tax Offset |

||||||||||||||||||||||||||||||

|

|

The most basic tax offset in Australia are Low Income Tax Offset (LITO) and Low and Middle Income Tax Offset (LMITO). The taxpayer does not have to do anything to claim the offsets. The ATO will work them out when the taxpayer lodge his tax return. The Table 4 is the offset criteria for LITO and LMITO. It can be noted that:

Table 4: Low, Low and Middle Income to Offset 2019/20

|

||||||||||||||||||||||||||||||

|

8. |

Declaration Method |

|

|

Taxpayers can choose to declare the tax by themselves or can choose a recognised tax agent to declare for themselves. Taxpayers can submit the tax returns through the ATO website or by submitting paper tax returns to ATO. |

| 9. |

Declaration Period |

|

|

The taxpayers are required to submit completed tax returns to the ATO or through the ATO website between July 1 and October 31. |

| 10. |

How to Pay or Refund the Tax |

|

|

After the taxpayer completes the tax declaration, in addition to the fact that there is no tax payable, there are generally two consequences, pay tax and get tax refund. There are two ways to pay the tax. Taxpayers can send a cheque to the AOT or pay the tax to ATO directly. There are also two ways for tax refunds. Taxpayers can require ATO to send a cheque to them or transfer the refund to the taxpayer's bank account directly. |

| 11. |

Example of Calculation of Individual Income Tax |

|

|

According to Australian tax laws, the calculation of Australian individual income tax uses an "Excessive Progressive Tax Rate". Unless otherwise specified, the calculation examples in this article do not consider deduction items, and only calculate wage income input. In practice, the actual situation shall prevail in the calculation of individual income tax. |

|

12. |

Individual Income Tax Calculation of Wages and Salaries |

|

|

|

(1) |

Australian Tax Residents Australia's tax burden on individual income tax payable by taxpayers for wages and salaries due to their employment and employment is significantly higher than in China. According to the agreement between China and Australia to avoid double taxation and to prevent tax evasion, Australian tax residents who earn wages and salaries in China and pay individual income tax in China are allowed to deduct Australian individual income tax payable, and only need to pay the difference in the individual income tax rate. For Australian tax residents who apply for individual income tax offset, they should keep the tax certificate of individual income tax paid abroad for verification. [Example 1] Tom as an Australian tax resident, worked in China for 7 months in the 2019-2020 tax year and earned a salary of AUD 22,000. Individual income tax has been paid in China of $ 1,780. Return to work in Australia for the remaining 5 months of the tax year and earn a salary of $ 20,000. Tom's individual income tax in Australia is calculated as follows:  Note: The above three steps are used by the ATO to calculate the maximum amount of individual income tax paid outside Australia that can be offset by the amount of individual income tax paid for wages and salaries. If an Australian tax resident has wages and salaries in certain countries with a higher tax burden than Australian and pays individual income tax, the offset amount that can be applied for will be less than the amount of individual income tax that has been paid, that is, the offset amount must not exceed the calculated upper limit. Since AU $ 5,695 is greater than the tax paid in China of AU $ 1,780, the tax paid in China can be fully offset.  |

|

|

(2) |

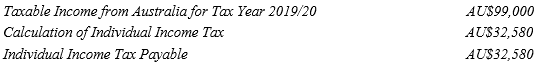

Non-Australian Tax Residents [Example 2] Brifty as a non-Australian tax resident, worked in China for 12 months in the 2019/20 tax year, but had income from Australia AU$99,000. Brifty only need to pay individual income tax for this part of income, and calculated as follows:  Note: Calculation of individual income tax: $29,250+($99,000-$90,000)*0.37=$32,580 |

|

Kaizen suggests you consult with professional tax advisors before you act upon the above information. Should you have any questions in relation to the proposals, please feel free to contact our CPAs. |

||

|

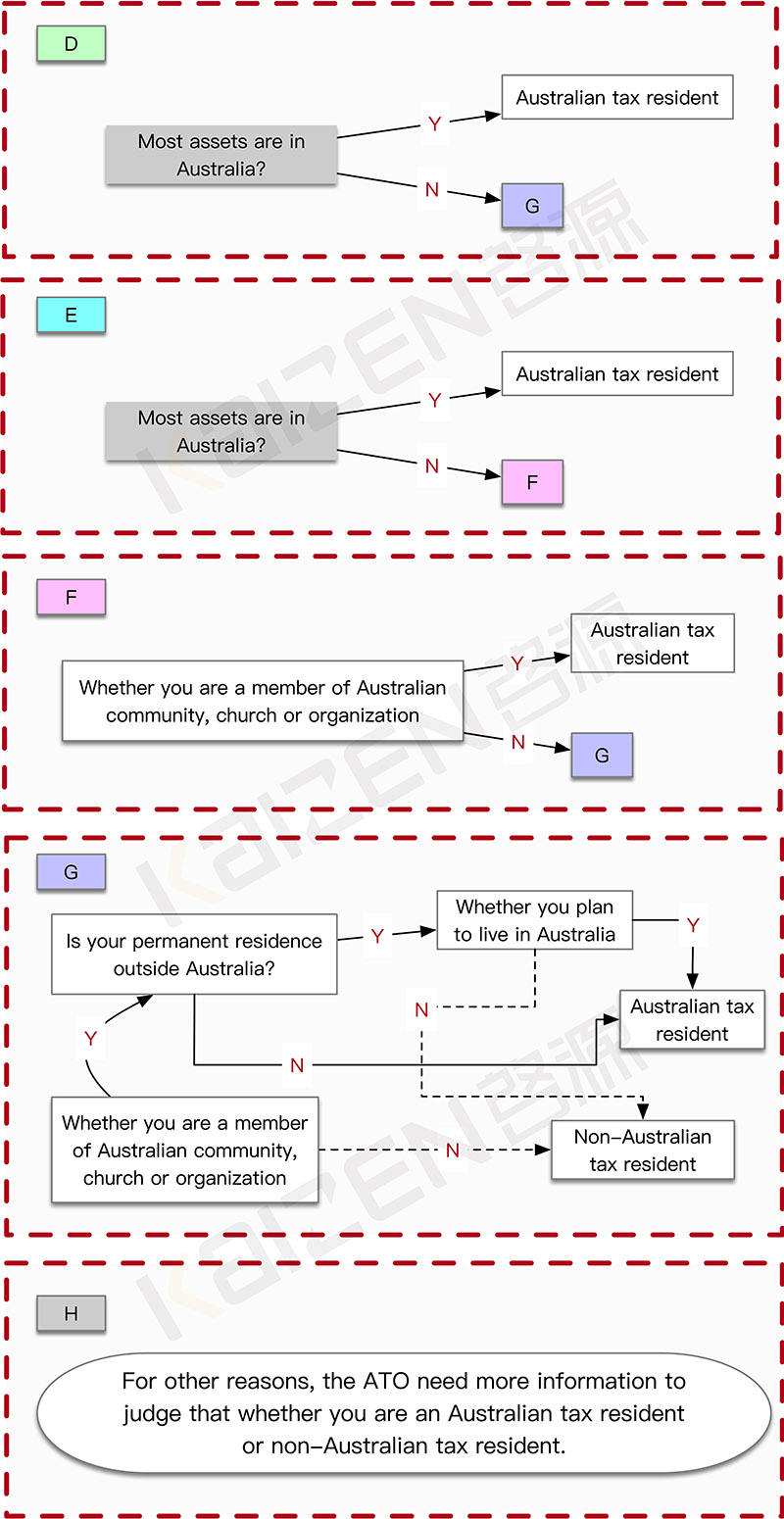

Appendix 1: Australian Residency Test Flowchart |

|

|

Disclaimer All information in this article is only for the purpose of information sharing, instead of professional suggestion. Kaizen will not assume any responsibility for loss or damage. |