UK Invoice Requirements and Template

It is a legal requirement for all sizes or nature of business to issue invoices for goods or services provided to customers in the UK and rest of the world.

The invoice must contain certain information to comply with UK tax regulations and to ensure that the transaction is properly recorded as record-keeping is essential for both of all businesses and HMRC.

Additionally, if a business is trading within the UK and is VAT registered, HMRC legally obliges the business to submit additional VAT information on the invoices.

For a limited company, full company name as it appears on the certificate of incorporation should be included on the invoices. There is no requirement to include company director names. However, if a business choose to include director names, all directors name should be disclosed.

For a sole trader, the full name of the proprietor as well as any business names use to operate the trades and an address where legal documents can be received must be printed on the invoices.

If a business is a VAT registered company, HMRC requires the VAT registration number and the rate of VAT must be included on all invoices.

A limited company must keep all business records including invoices for at least 6 years from the end of the accounting period but a sole trader is advised to keep records for at least five years.

-

Details to include on a UK Invoice

It is a legal requirement for all sizes or nature of business to issue invoices for goods or services provided to customers in the UK and rest of the world.

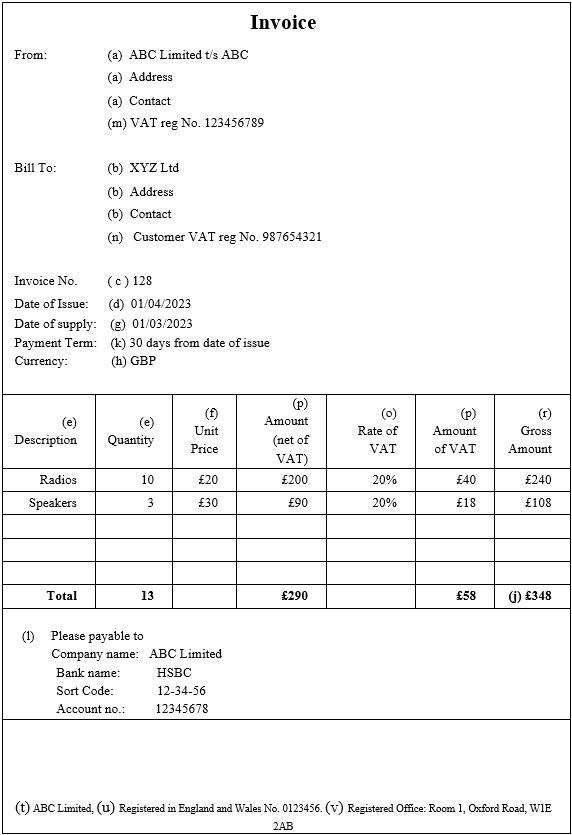

(1)

|

Common information must contain to comply with UK tax regulations:-

(a) The trading name, trading address and contact details;

(b) The name, address and contact details of the customer;

(c) A unique invoice number for identification of sales record;

(d) The issue date of the invoice;

(e) A list and description of the goods and services provided, including quantity;

(f) The individual price of the goods and services;

(g) The date of supply for the goods and services;

(h) The currency;

(i) The rate of any cash discount offered, if any;

(j) The amount owed;

(k) Payment terms;

(l) Banking information.

|

(2)

|

For a company is VAT registered, further VAT information must be included in addition to the above:-

(m) The business VAT registration number;

(n) The VAT registration number if the customer is VAT registered;

(o) The rate of VAT

(p) Amount of the VAT;

(q) The amount payable excluding VAT;

(r) The gross total amount payable including VAT;

(s) The total amount of VAT chargeable in sterling, if applicable

|

(3)

|

If it is a limited company, the following information must be included in all invoices and correspondences: -

(t) Full company name as it appears on the certificate of incorporation;

(u) Incorporation Registration number;

(v) Registered Office Address if difference from trading address.

|

-

Example of a VAT invoice

-

Keeping records for UK businesses

Limited companies in the UK must keep all business records including invoices for at least six years. A sole trader is advised to keep records for at least five years. If the 6-year rule causes serious storage problems or undue expense, companies can consult HMRC enquiries team, they may be able to shorten the period accordingly.

See Also:

UK Company Registration Procedures and Fees

UK Bookkeeping and Accounting Services

Introduction to EORI Number in the UK