![]() Home

Home

![]() Knowledge

Knowledge

![]() China

China ![]() China Taxes

China Taxes ![]() Individual Income Tax

Individual Income Tax ![]() China Individual Income Tax Specific Additional Deduction Criteria

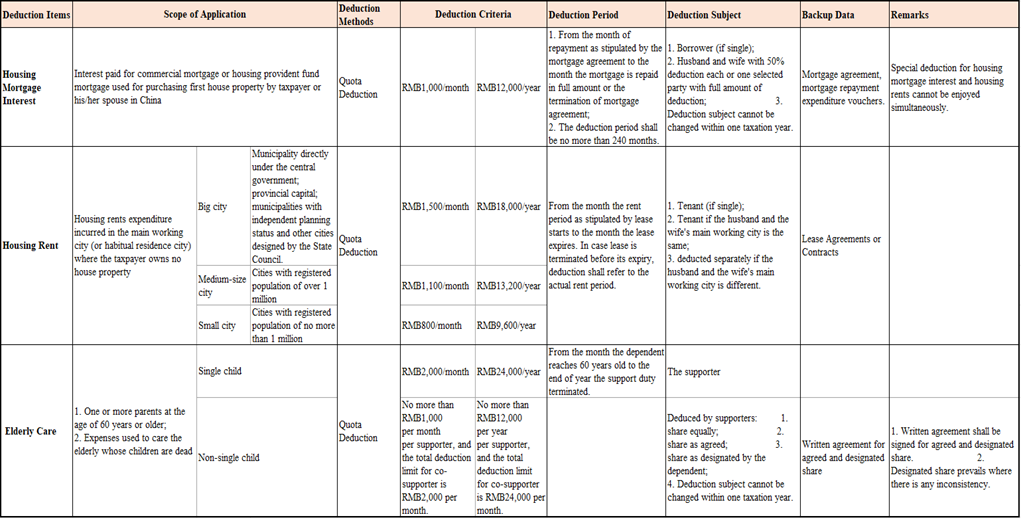

China Individual Income Tax Specific Additional Deduction Criteria

|

No. |

Item |

Time for Submission of Deduction Data and Application for Deduction |

|

1 |

Taxpayers enjoying specific additional deduction other than deduction for critical illness medical expenses |

a. Provide deduction data to the withholding agent and apply for accumulated deduction when handle monthly tax withholding and prepayment; or b. Submit deduction data to the competent tax authority directly and handle the deduction application by the taxpayers themselves during the annual income tax clearance to be done from 1st March to 30th June of the following year. |

|

2 |

Taxpayers not enjoying or not enjoying in full amount of specific additional deduction at tax withholding and prepayment step |

a. Provide deduction data to the withholding agent and apply for supplementary deduction in the remaining months of the year when handle tax withholding and prepayment; or b. Submit deduction data to the competent tax authority directly and handle the deduction application by the taxpayers themselves during the annual income tax clearance to be done from 1st March to 30th June of the following year. |

|

3 |

a. Taxpayers enjoying specific additional deduction for critical illness medical expenses; b. Taxpayers obtaining income from remuneration as labor service providers or authors, or from royalties with no salaries or wages income, who enjoy specific additional deductions; c. Taxpayers unwilling to submit specific additional deduction data to the employing companies |

Submit deduction data to the competent tax authority directly and handle the deduction application by the taxpayers themselves during the annual income tax clearance to be done from 1st March to 30th June of the following year. |

|

Disclaimer All information in this article is only for the purpose of information sharing, instead of professional suggestion. Kaizen will not assume any responsibility for loss or damage. |