|

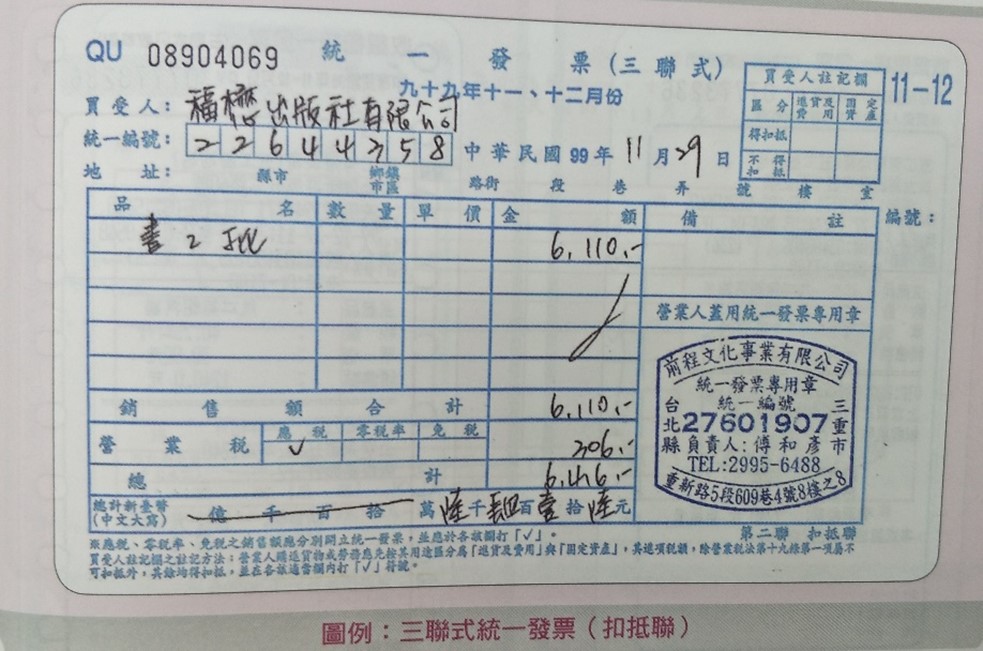

(1) |

Triplicate Uniform Invoice: A business entity issues this type of invoice to another business entity (B to B).  |

|

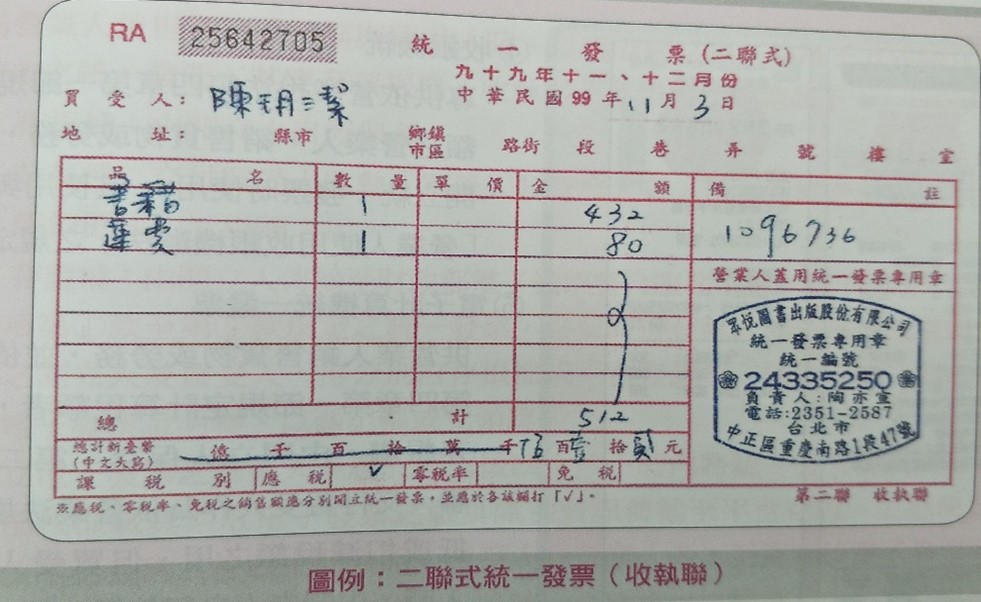

(2) |

Duplicate Uniform Invoice: A business entity issues this type of invoice to a customer (B to C). |

|

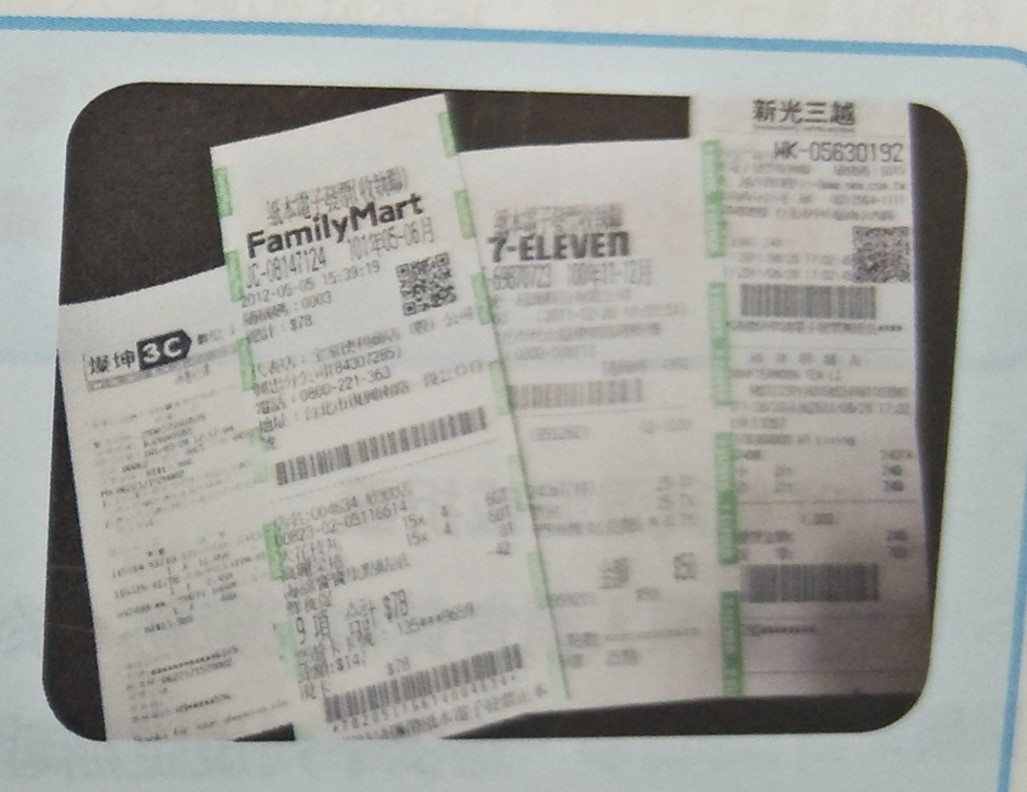

(3) |

Cashier Invoice: A business entity issues this type of invoice to a purchaser (including business entities (B to B) and customers (B to C)), or it can be divided into triplicate form (stub copy, receipt copy, and deduction copy) and duplicate form (stub copy and receipt copy) for the sake of bookkeeping. 3-1. Cashier Invoice in triplicate from 3-2 Cashier invoice in duplicate form |

|

(4) |

Electronic Invoice: A business entity issues this type of invoice to a purchaser (including business entities (B to B) and customers (B to C)) |

|

(1) |

In the event a business entity fails to record the necessary particulars or records false data on issuing uniform invoices, in addition to being ordered to make corrections or fulfill the requirements within a specified time limit, the business entity shall be fined an administrative fine of 1% of the sales amount on the uniform invoice, but in an amount of no less than NT$1,500 and no more than NT$15,000. In case the business entity fails to make corrections or fulfill the requirements after being notified or fails to make appropriate corrections or fulfill the appropriate requirements, the penalty shall be imposed consecutively for each violation according to the relevant laws and regulations. |

|

(2) |

In case the aforementioned unrecorded or false recorded item on the uniform invoice is the name, address, or business administration number of the purchaser, the second and the subsequent punishment shall be 2% of the sales amount stated on the invoice and shall be no less than NT$3,000 and no more than NT$30,000. |

|

Disclaimer All information in this article is only for the purpose of information sharing, instead of professional suggestion. Kaizen will not assume any responsibility for loss or damage. |