![]() Home

Home

![]() Knowledge

Knowledge

![]() China

China ![]() China Taxes

China Taxes ![]() Individual Income Tax

Individual Income Tax ![]() 2022 China Special Additional Deduction and Withholding Agents

2022 China Special Additional Deduction and Withholding Agents

|

(1) |

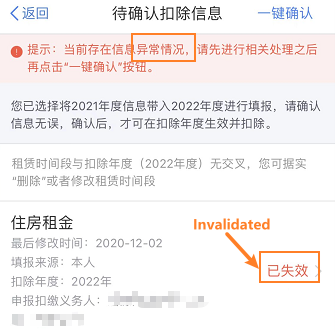

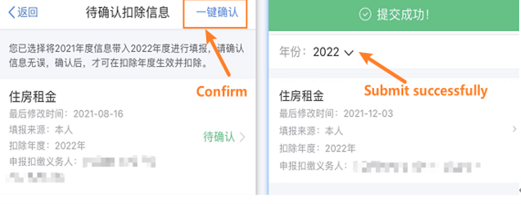

By IIT APP Step 1: Click on homepage of 【Enter¬—Confirm】  Step 2: Click 【Confirm】【2022】  If there is an abnormal situation, please slide left on the screen to delete the【Invalidated】 item, as shown below:  Step 3: Click【Confirm】The modification is successfully.  |

|

(2) |

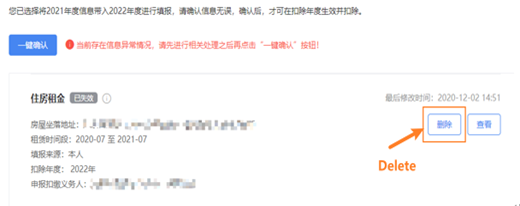

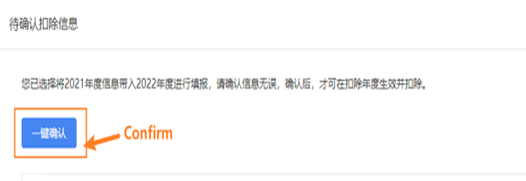

By Website: Step 1: Log in the website (https://etax.chinatax.gov.cn//) and click【Tax handling】【2022】【Confirm】  If there is an abnormal situation, please slide left on the screen to delete the【Invalidated】 item, as shown below:  Step 2: Click 【Confirm】  |

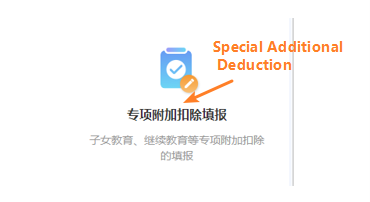

| (1) |

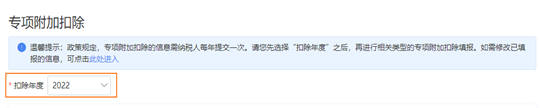

By IIT APP Step1 : Click on the homepage of 【Special Additional Deduction Declaration】  Step 2: Click 【Deduction Year】and choose “2022”, and complete the deduction information.  |

|

(2) |

By Website: Step 1: Click 【Special Additional Deduction】  Step 2: Click 【Deduction Year】and choose “2022”, and complete the deduction information.  |

|

(1) |

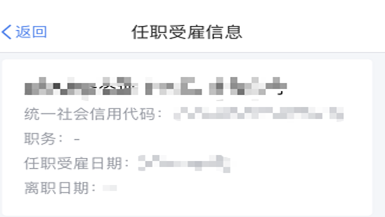

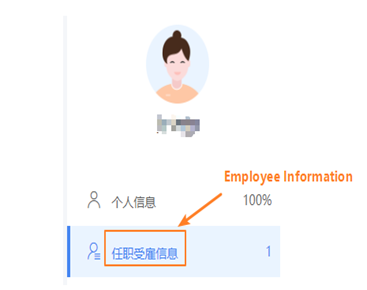

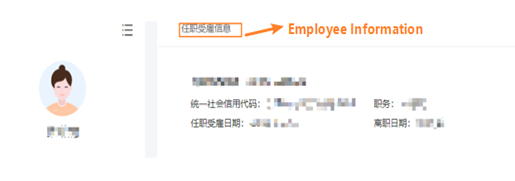

By IIT APP Step 1: Click 【Personal Information】-【Employment Information】  Step 2: Choose Withholding Agent  |

|

(2) |

By Website: Step 1: Click 【Complete Personal Information】  Step 2: Click 【Employment Information】  Step 3: Choose Withholding Agent  |

|

Disclaimer All information in this article is only for the purpose of information sharing, instead of professional suggestion. Kaizen will not assume any responsibility for loss or damage. |