Q:

|

What are the two-tiered profits tax rates?

|

|

A:

|

Under the two-tiered profits tax rates regime, the profits tax rate of Hong Kong corporations for the first HK$2 million of assessable profits will be lowered to 8.25% while for Hong Kong partnerships and Hong Kong sole proprietorships, it will be lowered to 7.5%. Assessable profits above HK$2 million will continue to be subject to the rate of 16.5% and 15% respectively.

|

Q:

|

Which entities would and would not qualify for the two-tiered profits tax rates?

|

A:

|

Basically, all entities with profits chargeable to Profits Tax in Hong Kong would qualify for the two-tiered profits tax rates, except those entities with a connected entity which is nominated to be chargeable at the two-tiered rates. Further, corporations which has made an election under section 14B(2)(a) (qualifying professional reinsurance business and authorized captive insurance business), section 14D(5)(b) (qualifying corporate treasury centre), section 14H(4)(b) (qualifying aircraft lessor) or section 14J(5)(b) (qualifying aircraft leasing manager) also will not qualify for the two-tiered rates.

|

Q:

|

What is the meaning of connected entity?

|

A:

|

An entity is a connected entity of another entity if:

1.

|

one of them has control over the other; or

|

|

2.

|

both of them are under the control of the same entity; or

|

|

3.

|

both of them are sole proprietorship business carried on by the same person.

|

|

Q:

|

How is control determined?

|

A:

|

Generally, an entity has control over another entity if the first-mentioned entity, whether directly or indirectly through one or more than one other entity:

1.

|

owns or controls more than 50% in aggregate of the issued share capital of the latter entity; or

|

|

2.

|

is entitled to exercise or control the exercise of more than 50% in aggregate of the voting rights in the latter entity; or

|

|

3.

|

is entitled to more than 50% in aggregate of the capital or profits of the latter entity.

|

|

Q:

|

How to lodge a claim of the two-tiered profits tax rates for a Hong Kong corporation?

|

A:

|

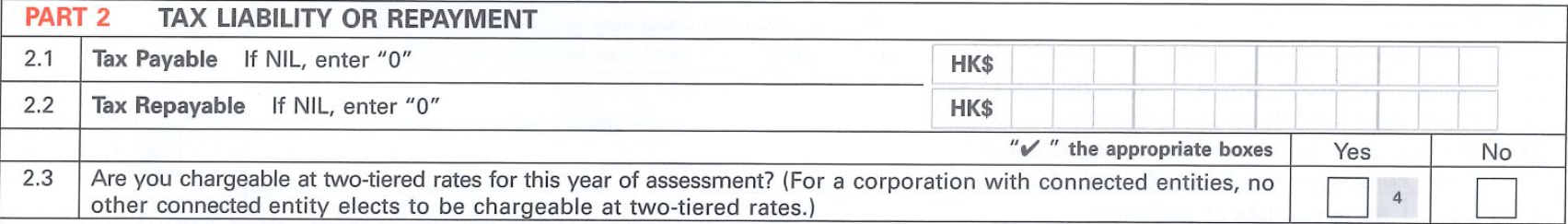

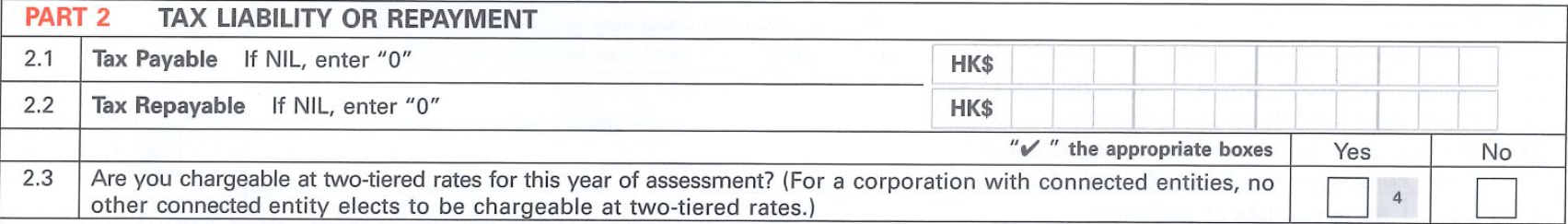

You may make an election for the two-tiered profits tax rates by completing Part 2.3 of Profits Tax Return – Corporations (BIR51) for the relevant year of assessment.

|