Frequently Asked Questions for the Deduction for Home Loan Interest in Hong Kong

| Q: | What kind of conditions should be satisfied before a deduction for home loan interest is granted in Hong Kong? |

| A: |

All of the following conditions must be satisfied before a

deduction for home loan interest paid is granted: |

| Q: | What is the tax treatment if I own more than one place of residence in Hong Kong? |

| A: |

You are entitled to claim the deduction for your principal place of residence only if you own more than one place of residence.

|

| Q: | What is the maximum number of years of deduction? |

| A: |

The number of years of deduction for home loan interest is extended from

10 to 15 years of assessment effective from the year of assessment 2012/13,

while it was further extended to 20 years starting from the year of assessment

2017/18. Claiming for deduction for home loan interest in consecutive years is

not necessary. The current deduction ceiling is HK$100,000 for a year. |

| Q: | If my income from employment is less than personal allowances, what is the tax treatment on the interest paid during the relevant year of assessment? |

| A: |

Since your income is less than your personal

allowances, you are exempt from tax even without taking into account the

deduction of home loan interest. In this situation, you will not be treated as having

been allowed the home loan interest deduction for that year and your remaining

years of entitlement for the deduction will be unchanged. |

| Q: | How can I claim the deduction for home loan interest in Hong Kong? |

| A: |

You can claim a deduction for home loan interest

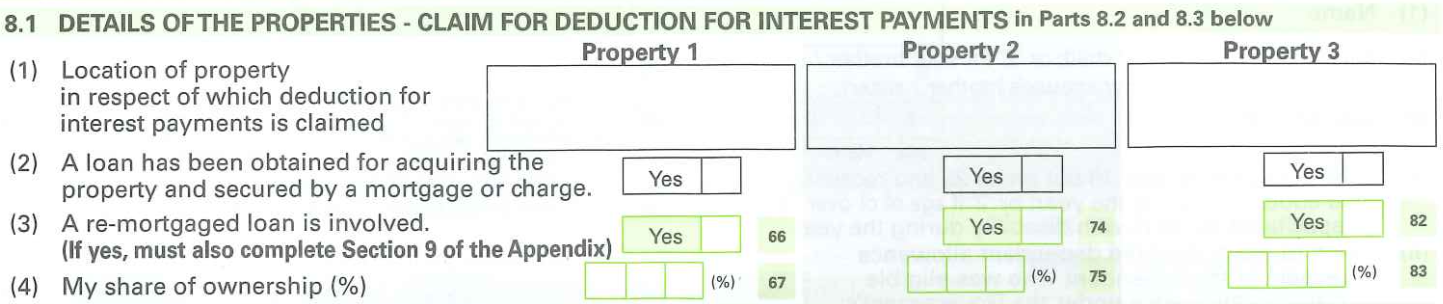

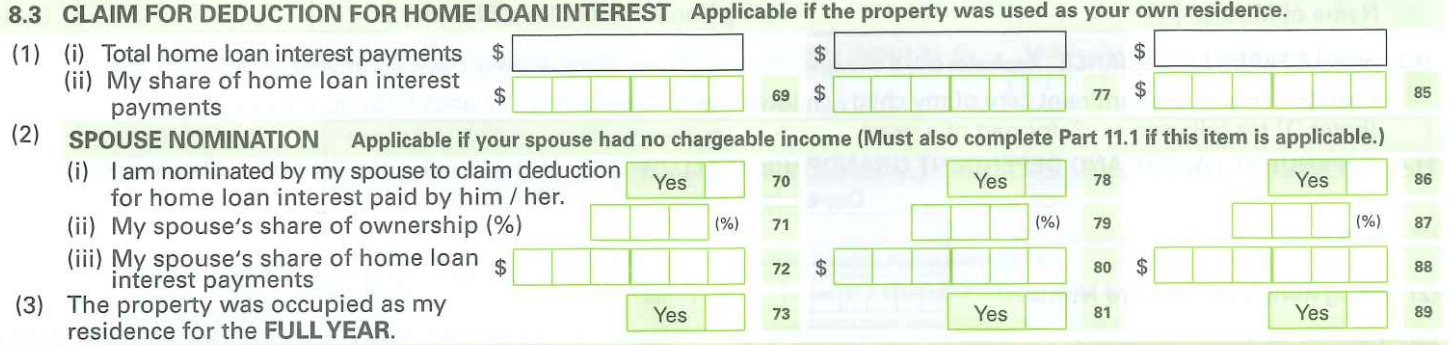

by completing Part 8.1 and 8.3 of your tax return (BIR60) for the relevant year

of assessment.  |